QR Energy LP (QRE) invests in, explores, develops, and produces oil, NGLs, and natural gas from US onshore properties. It IPO'd recently in December 2010. It pays a great 11% dividend, but it hasn't been able to find a lot of buyers recently. It has been in a long term downtrend for the past year or more (see the two year chart below).

(click to enlarge)

The slow stochastic sub chart shows that QRE is near oversold territory. The main chart shows that QRE has been in a downtrend since early 2012. The 200-day SMA is down trending. The 50-day SMA is below the 200-day SMA, which is bearish. In sum the chart looks ugly. Do the fundamentals bear out this picture?

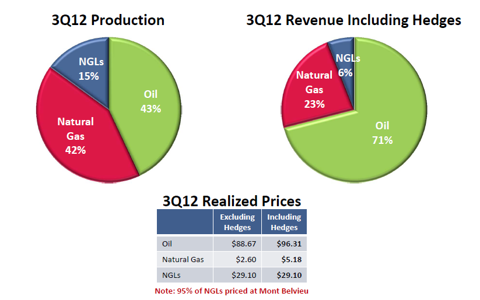

No. QRE seems to be suffering from a plethora of abnormal negative factors. One of these factors concerns QRE's production distribution. The chart below shows QRE's production distribution.

(click to enlarge)

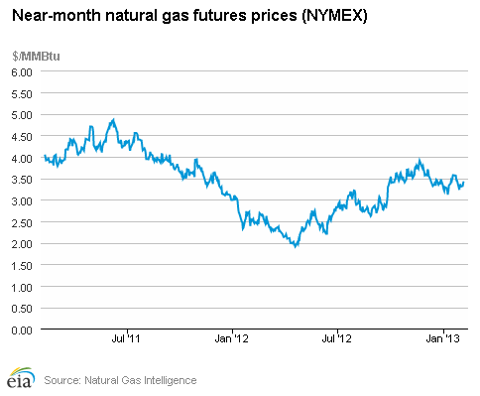

As you can see from the chart, 42% of production is natural gas and 15% is NGLs. Both of these have seen their prices fall dramatically in the last year. This has made QRE less profitable even though it has hedges. For the Q4 2012 results, QRE says it has production 77% hedged. This means it will still suffer from low natural gas prices. However, those prices will be significantly higher than in Q1 and Q2 of 2012 (see 2 year natural gas price chart below from the EIA outlook).

(click to enlarge)

The above chart shows that the average natural gas price for Q4 2012 was higher on average than the average price in any of the previous quarters in 2012. This means QRE profits should go up. However, there will still appear to be a couple of problems in this area. First QRE has natural gas hedges for many years into the future. One can look at these as put options at approximately $5/MMbtu. Therefore when the price of natural gas goes up, the value of the put options for years into the future goes down. Since natural gas did on average go up in Q4 versus Q3 2012, QRE's hedges will become less valuable both in Q4 and in all of the future quarters for which they exist. This is unlikely to be as big a loss as QRE saw in Q3 on unrealized derivatives, but it will still be sizeable.

To illustrate, the unrealized loss on derivatives was $56 million in Q3 2012. QRE will likely have a slightly smaller unrealized loss on derivatives in Q4 2012. However, it will not mean that the company is unprofitable. It will in fact mean that the company is making more money due to higher priced natural gas. A smart investor learns to interpret such accounting artifacts. Higher natural gas prices are overall good for QRE.

Second accounted values for reserves are based on the rolling twelve month average price for a petroleum product. By looking at the natural gas chart above, you can see that Q4 2012 will replace a roughly similarly valued Q4 in 2011. There might be a slight lowering of the rolling 12-month average (or a slight raise of it), but this should not cause a significant change in QRE's natural gas reserves valuation. Instead it seems likely that the average natural gas price will be substantially higher in Q1-Q3 of 2013 (and likely beyond) than in Q1-Q3 of 2012. This means that in Q1-Q3 of 2013 QRE's natural gas reserves value will rise as the rolling 12-month average price increases. This is a positive for QRE, especially since some investors only look at the numbers.

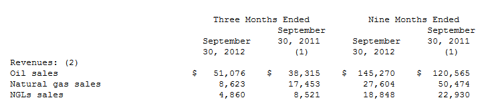

Another good point in QRE's favor is that it has been growing oil production relative to other types of production. This is good because oil prices have remained relatively high, while both natural gas and natural gas liquids prices have fallen (see the table below). This has helped QRE gain revenues, even with troubled natural gas and NGLs prices.

(click to enlarge)

QRE pushed this strategy farther in Q4. It agreed to acquire $215 million in conventional, low risk, low decline oil properties in the Ark-La-Tex area. The current net production from this property is 1,400 Boepd (90% oil). Estimated total proved reserves were 10.7 MMBoe as of November 1, 2012, which were 99% proved developed (76% proved developed producing). QRE has since closed on this acquisition. QRE also agreed to acquire $145 million of oil properties in the Jay Field in the Florida Gulf Coast from its sponsor, Quantum Resources Fund. This transaction closed December 28, 2012. The current production from this field is 2,500 Boepd of which 90% is oil and 10% is NGLs. In other words, QRE has added about 3500 barrels of oil per day of new oil production in these two transactions (I took out the natural gas and NGLs production). This will all be immediately accretive to revenues; and a roughly +50% pop in oil production should help both the top and the bottom lines in coming quarters. Guidance from QRE on earnings should be a noticeable improvement over recent quarters.

Oil production in Q3 2012 was 43% of total daily production of 14,620 barrels of oil equivalent per day or about 6300 barrels of oil per day. If this provided 71% of the revenues (including hedges), investors can expect to see a significant pop in revenues in 2013 with the added 3500 barrels of oil per day of production from these two deals. Yes there will be some share dilution due to new stock issued recently, but there will still be a substantial pop on revenues on a per share basis.

Despite all of its problems in Q3 2012, QRE still had distribution coverage of 1.1x. The above "oily" purchases should push the distribution coverage and the possibly the distribution itself upward in subsequent quarters. The higher natural gas prices in Q4 2012 and Q1 2013 so far (and likely in future quarters) should add to revenues.

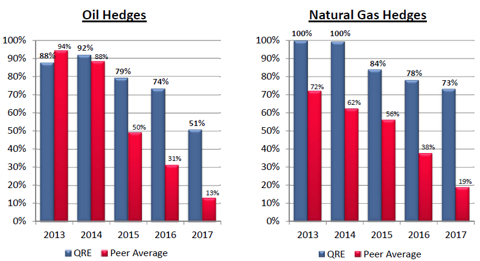

For 2013 and 2014 QRE is well hedged. The company's revenue should be relatively steady except for gains in production. The chart below shows QRE's hedges.

(click to enlarge)

This level of hedging should give QRE good revenue stability, even if the price of natural gas or oil falls in a recession. Investors should still expect more unrealized losses on commodity derivative contracts in Q4 2012 results. However, such losses should diminish in Q4 2012 and Q1 2013. Plus if they should continue, it will eventually mean that the natural gas and the oil prices have risen beyond the lower values of hedges. This should mean greater profits for QRE. Investors need to pay attention to the actual long term meaning of the unrealized derivatives losses. Often they mean the company will be more profitable instead of less profitable. The most important numbers from Q3 2012 are the adjusted EBITDA of $52,199,000, the distributable cash flow of $23,258,000, and the distribution coverage ratio of 1.1x. These figures should see good pops in Q4 2012 and beyond (even on a per unit basis), although QRE has targeted 1.2x as its long term distribution coverage ratio goal. Therefore the growth on that metric should be limited. This only means that distributions would increase instead of that metric.

In sum QRE is a buy with a caveat. It is still a new, lowly capitalized company with a market cap of only $791 million and an enterprise value of only $1.39B. It is a recent IPO (December 2010). The market and the bankers do not have as much faith in it as they do in more established energy MLPs. This means it could be hurt more in a US recession. That being said, the outlook for QRE is improving. The fundamental financial numbers should provide improving news in future quarters. At the very least, QRE seems to have managed through the worries that started its downtrend. Without a recession, the stock price is fundamentally due to turn upward. With a possible recession as a possibility, a sensible approach is to average into your desired position in QRE over the course of 2013. This should ensure a good average entry price. With QRE relatively oversold currently, now is a good time to start to buy in, especially with the upswing in fundamentals likely to be in upcoming news. The average analyst's EPS growth estimate is for 65% growth in 2013. That's fantastic for a company like QRE. The average analyst's recommendation on QRE is 1.8 (a buy). CAPS rates QRE four stars (a buy). QRE is a good, high yield selection for your portfolio.

NOTE: Some of the fundamentals financial data above is from Yahoo Finance.

Good Luck Trading.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in QRE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.